Sales And Rental Indexes Released

A quick blog from me today regarding the Dubai Real Estate Market current conditions following the release of the House and Rental Price Index today.

It takes the teams a while to collate and produce the reports, these documents were released today and cover the full month of January, so we may not have seen changes that have occurred in the past few weeks however, none the less the fundamental market conditions remain the same.

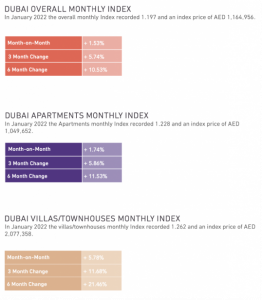

Please see a snapshot below with links to the full reports at the end of the email.

Latest Data Available

A quick email from me today regarding the Dubai Real Estate Market current conditions following the release of the House and Rental Price Index today.

It takes the teams a while to collate and produce the reports, these documents were released today and cover the full month of January, so we may not have seen changes that have occurred in the past few weeks however, none the less the fundamental market conditions remain the same.

Please see a snapshot below with links to the full reports at the end of the email.

Source: MO’ASHER The Official Sales Price Index for the Emirate of Dubai Jan 2022 (released March 16th)

Key Findings

January 2022 is the best start to the year on record with 5,797 sales transactions worth AED 16.69 billion.

Compared to January 2021, off-plan volume increased by 183.05 percent and value increased by 307.88 percent

Off-plan real estate sales volume increased by 50.9 percent and value increased by 55.4 percent, month-on-month.

In January 2022, 53 percent of sales transactions were in the secondary/ready market and 47 percent were off-plan

“Based on numerous factors such as the data and trend patterns, it looks like 2022 will continue on an upward trajectory when it comes to sales volumes and price”

Rental Hot Spots

Source: Property Monitor

You can also read a new press report from today summarising more recent CBRE market analysis Here.

My Summary

As well as monitoring market data, speaking to investors and developers on a daily basis gives me a good idea of what’s happening in real time, rather than looking at data which is a month or so old, the sentiment is still hugely positive in the market place here in Dubai with a number of high profile projects selling in record times, developers hiring areas for product launches etc – there are few global markets with as much attention as Dubai currently.

There have been a few mentions of the impact of the European unrest on the market, however, I’ve found that this has been directly with individual investors and investor groups that have a business presence in the key countries effected, largely appetite from global investors remains significant in Dubai. I do foresee a slight increase in occupancy rates and capital flowing from Europe into the region.

To date, there hasn’t been any major trigger which will cause the Dubai market to soften this year in my opinion, I do foresee the rate at which villa/townhouses have increased to soften slightly, however, the overall trajectory of the Dubai market I predict will remain the same for the rest of 2022 despite the Expo coming to an end.

If you own property in Dubai, or are considering investing, I would highly recommend reviewing the short term let market as a letting strategy, many owners are seeing much larger yield % rates in comparison to traditional long term lets, upwards of 10% net after costs in some cases.

Also, due to the appetite in the market place, the payment plans from developers which caused such huge demand a few years back have started to slow down. Developers are being slightly less generous with incentives such as shorter payment timeframes, larger deposit levels, less DLD waivers and fewer post-handover payment plans available – so I would encourage investors to utilise this model before it’s phased out further as sales activity continues to remain high.

Many thanks,

Nick Hyland

CEO